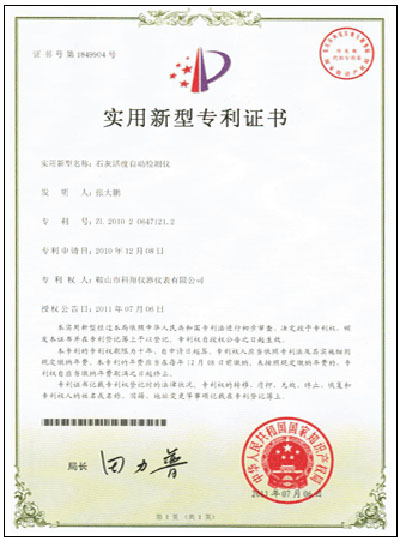

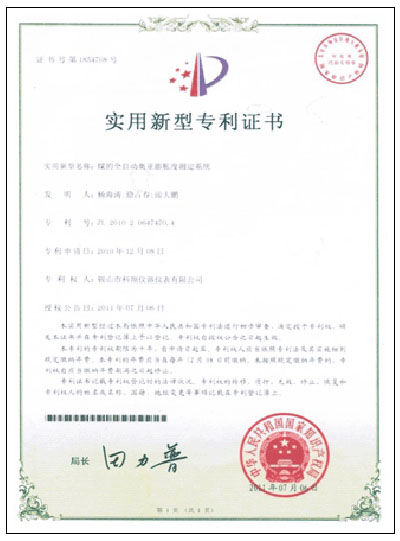

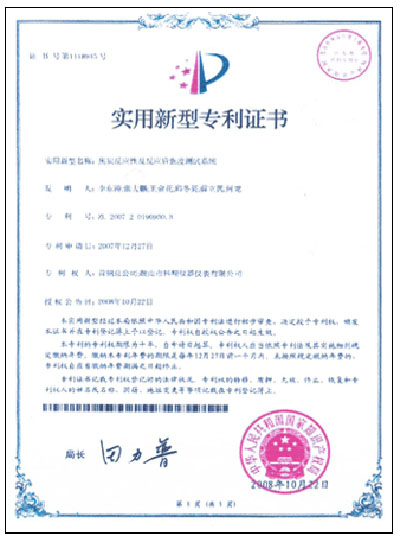

XINGKONG.COM(中国)有限公司成立于2002年,注册资金2000万元,占地面积5000平方米,是一家专业从事冶金实验设备研发、生产和销售的高新技术企业。公司现有员工200余人,设有独立的产品研发小组20人,工程技术人员54人,销售至售后服务人员45人。公司已形成从产品研发、生产、销售至售后服务的完整体系,并已通过ISO9001:2008质量管理体系认证。产品远销印尼、印度、乌克兰和东南亚等国,深受客户的普遍欢迎和广泛赞誉。公司以“创新领先”为目标,在技术上投入了大量的资金,从而使得我公司的产品技术一直保持在行业的前列,并已获得七项国家专利。其中全自动煤焦岩相分析系统、全自动基氏流动度测定仪、全自动胶质层指数测定仪的主要核心技术。

研发

生产

销售

XINGKONG.COM(中国)有限公司

电 话:0412-8252920 0412-8252930

传 真:0412-8246602

手 机:13050084493

售后服务部:0412-8285080

新疆市场部:

手 机:18641242835

电 话:0991-3651089

邮 编:114018

邮 箱:Lnaskx@126.com

网 址:http://www.teknalysis.com

地 址:辽宁省鞍山市铁西区协作路39号

联系人:张经理

Copyright © 2022 XINGKONG.COM(中国)有限公司 Inc All Right Reserved. 辽ICP备20001023号-1 营业执照 技术支持:鞍山龙采

电话:0412-8252920 0412-8252930 传真:0412-8246602 手机:13050084493 售后服务部:0412-8285080 新疆市场部 手机:18641242835 电话:0991-3651089

网站部分资源来自互联网公开渠道 如有侵权请及时联系本司删除